Let’s face it, there is a lot going on in the world right now. In the homebuilding industry, COVID-19 has had a drastic impact on the cost of materials and therefore the price of the home. Despite this price increase, now is a great time to build a new home due to the historical low interest rates, but let’s take a closer look….

What is happening with pricing?

Lumber and material pricing for building a home has increased drastically in the past six months. Most materials are double the previous price and some three or four times more. According to the National Association of Home Builders, the average new construction home price has increased by $16,000 since April 2020 due to material costs.

Why?

Initially, when the COVID-19 Pandemic began, the demand for lumber decreased. lumber mills began cutting production, but with incredible numbers of Americans “working from home” the demand sharply increased as many people took on “DIY” home projects. As lumber mills ramped up production, many were forced to close for periods of time due to virus outbreaks within the workforce. In addition, an already bustling home market continued to increase at a rapid pace. All of these factors created a perfect storm of very low supply and very high demand. Add in the lumber tariffs and hurricane season, which all means pricing has had nowhere to go but up.

Now what? Most building industry suppliers implement price increases in late winter or early spring. We have already seen skyrocketing “surcharges” applied over the summer. Typically, these surcharges are temporary, but the outlook is these surcharges will become permanent price increases or be adjusted only slightly going into 2021. In short, the increases in pricing may be here to stay or may relax only slightly. In the 23 years that Silverpoint Homes has been in business, we have NEVER seen the total building price go down more than 2%.

What is happening with Mortgage Interest Rates?

This is the really good news. Mortgage Interest Rates are at the lowest point in history. As of now, the average mortgage interest rate on a 30-year fixed mortgage loan is around 3% (We just had a customer lock in at 2.75% for 30 years!). If we look back at May 2019, the average interest rate was around 4% and a year earlier in 2018 the average interest rate was 5%. Although 4% or 5% are historically great mortgage interest rates, that 1% to 2% makes a huge difference. Literally, tens of thousands of dollars over the life of a loan.

Historically interest rates have remained constant during election season so they are unlikely to change dramatically in the next few months. However, once the election is over it is anyone’s guess what will happen. One thing we know for certain, mortgage interest rates have nowhere to go but up.

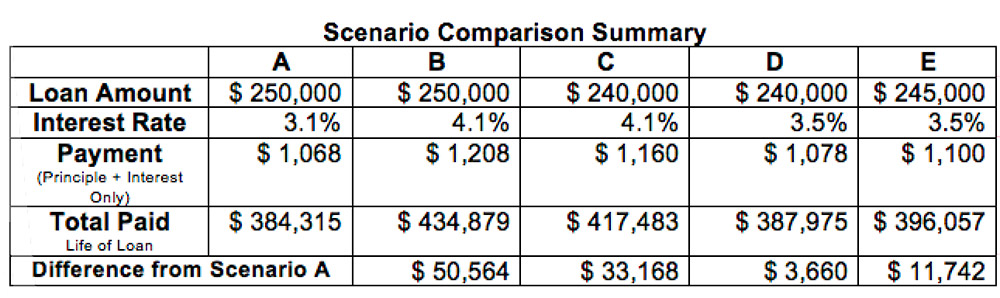

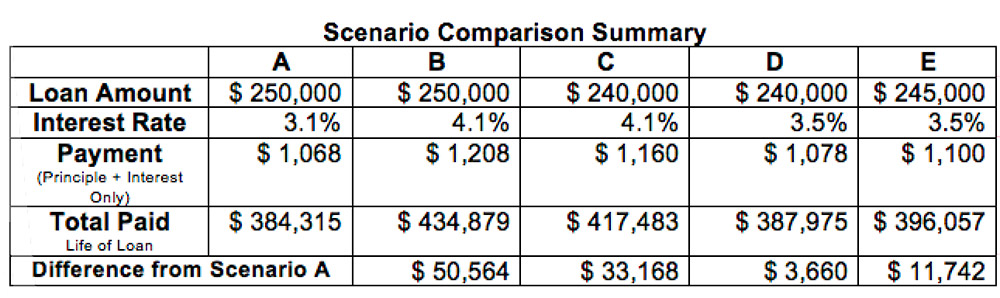

How does this interest rate affect you? Small changes in interest will have a large impact on your payments and balance over the life of the loan. Let’s look at a few example scenarios of a $250,000 home:

Scenario A) Build now at current interest rate of 3.1%

Scenario B) Wait until spring at same price and interest rate increases to 4.1%

Scenario C) Wait until spring with material prices decrease cost by $10,000 (an unrealistic 4% decrease) and interest rate increases to 4.1%

Scenario D) Wait until spring with material prices decrease cost by $10,000 (an unrealistic 4% decrease) and interest rates increase just slightly to 3.5%

Scenario E) Wait until spring with material price decrease cost by $5,000 (realistic 2% decrease) and interest rates increase slightly to 3.5%. We think this is the most realistic scenario in Spring 2021.

The difference in now (Scenario A) and “hoping” for materials costs to significantly decrease with just a slight in increase in interest rate (Scenario D) is just $10 per month! However, in either scenario with an increase in interest rate to 4.1% (Scenario B or C), it is a huge difference in monthly payment and total paid.

What is the right decision for you?

Ultimately, building your new dream home is likely the biggest investment you will make and you need to feel comfortable with your decision. None of us can predict the future, but we can use the past as a guide. This means we can expect mortgage rates to rise. How much is anyone’s guess.

Material rates and home pricing are likely to remain elevated for the foreseeable future. Although we may experience a leveling off of current pricing, it is very unlikely pricing will return to pre COVID levels.

The most likely scenario is you are better off to build your home now. Waiting to build your new home is a huge risk with a likely unfavorable outcome.

Schedule an appointment to visit us today and let’s talk about your dream home scenario and what is best for you!

People don’t often refer to building a new home as a joyful experience. But that’s exactly how Silverpoint Homes homeowners describe how they feel after they’ve built a home with us.

People don’t often refer to building a new home as a joyful experience. But that’s exactly how Silverpoint Homes homeowners describe how they feel after they’ve built a home with us. If you’re still considering a new home over purchasing

an existing propertyhome, we really need to talk soon.

If you’re still considering a new home over purchasing

an existing propertyhome, we really need to talk soon.

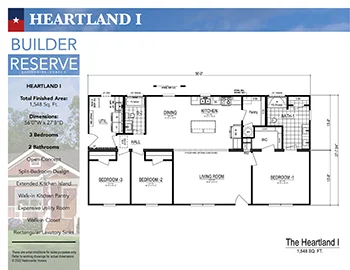

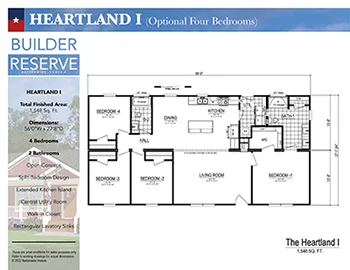

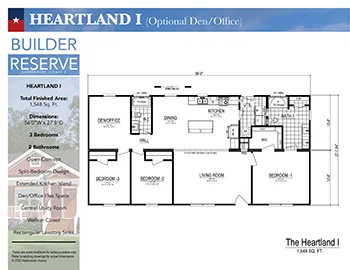

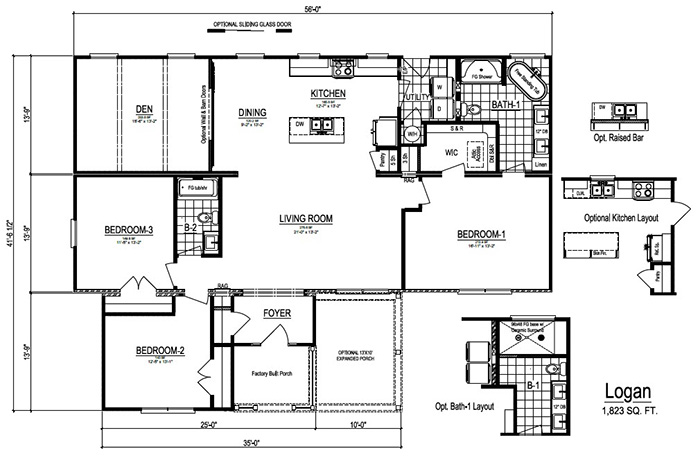

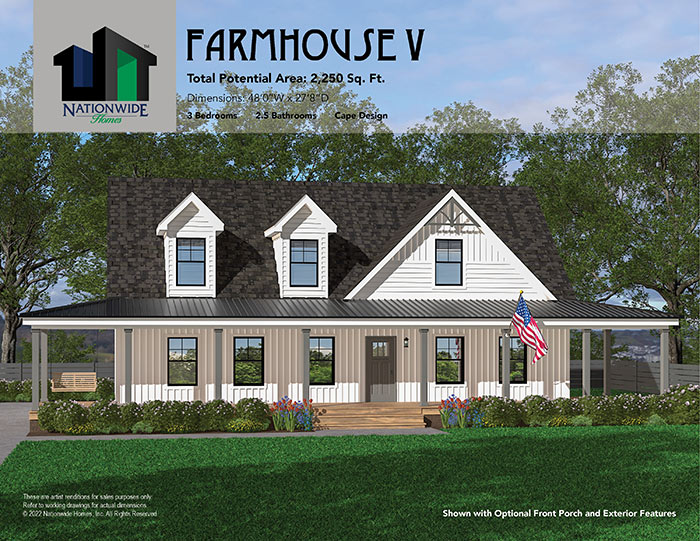

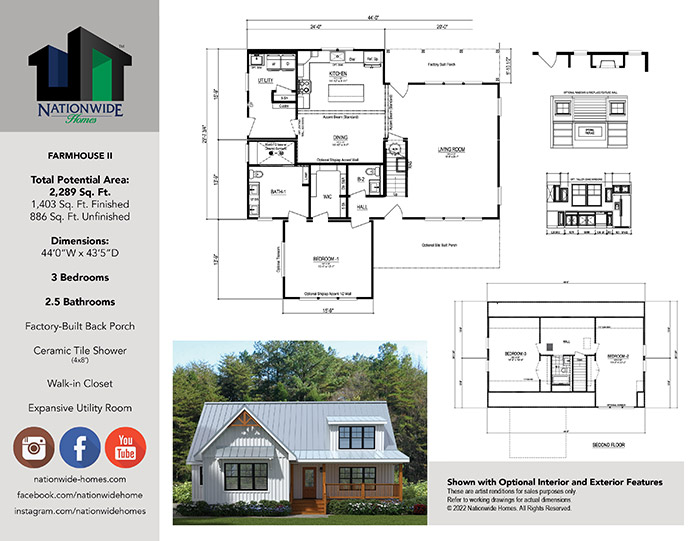

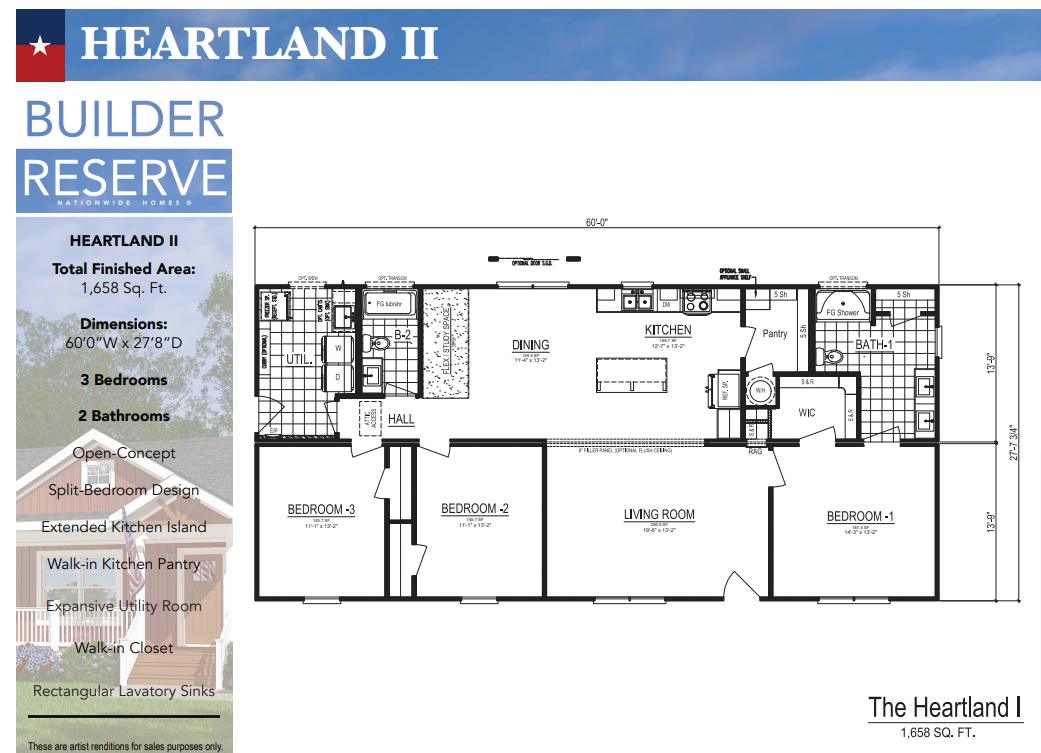

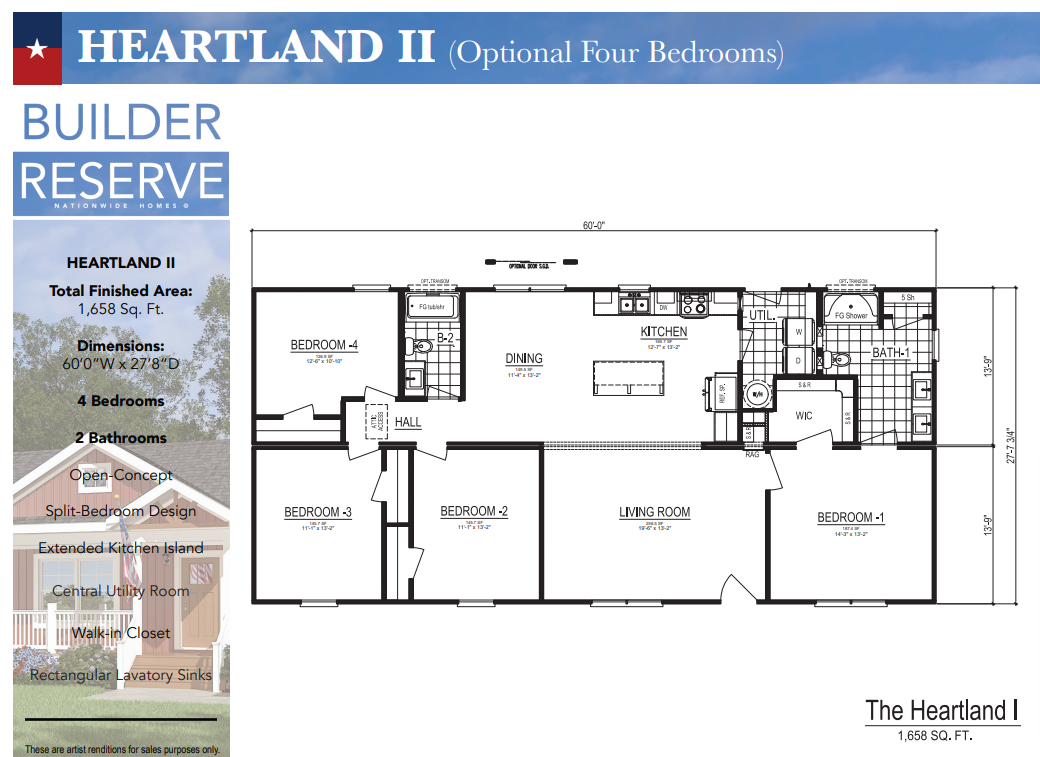

When it comes to selecting a new home, certainly you have a list of “must haves”. That’s part of the fun in envisioning your dream home, wouldn’t you agree?

When it comes to selecting a new home, certainly you have a list of “must haves”. That’s part of the fun in envisioning your dream home, wouldn’t you agree? If you’re still considering a new home over purchasing an existing home, we really need to talk soon.

If you’re still considering a new home over purchasing an existing home, we really need to talk soon. People don’t often refer to building a new home as a joyful experience. But that’s exactly how Silverpoint Homes homeowners describe how they feel after they’ve built a home with us.

People don’t often refer to building a new home as a joyful experience. But that’s exactly how Silverpoint Homes homeowners describe how they feel after they’ve built a home with us.